Duration: 10 - 12 hours

Business Lending Fundamentals helps your community bank tap into the lucrative small business market by providing your staff with the skills they need to successfully evaluate the credit needs of small businesses and establish credibility with their owners through case studies and discussion.

Duration: 18 - 24 hours

Consumer Lending ensures your lenders are equipped with the skills they need to make sound consumer loan decisions by effectively evaluating loan requests, identifying risks, and monitoring loans and consumer lines of credit.

Duration: 25 - 30 hours

In Commercial Loans to Small Business, participants use the Decision Strategy™ to perform an in-depth analysis of small business credit requests. This course emphasizes interpretation and analysis using real-world lending examples that include personal guarantees.

Duration: 16 - 20 hours

Understanding Personal Cash Flow builds advanced skills in analyzing personal financial statements and tax returns. The E-Learning course focuses on determining the financial strength of a borrower or guarantor through an analysis of assets, liabilities, and cash flow.

Duration: 15 - 20 hours

Financial Accounting for Lenders presents accounting from the lender's point of view, and empowers participants with the skills needed to extract critical information from financial statements that informs risk analysis and lending decisions.

Duration: 1-2 hours

Building Small Business Acumen builds participants' skills in communicating effectively with small business owners. Participants learn to confidently discuss goals, operations, challenges, and opportunities in ways that are meaningful to small business owners, and recommend solutions aligned with clients' needs.

"In my preliminary analysis of a loan request...I will have a better understanding of my client's requirements, and will be able to better mitigate any risks with my recommendations for financing requests."

"This training has made me more capable of recognizing good credit. I think it is important to develop judgement skills when analyzing credit oportunities and there is no question that this training improved my ability to do just that."

"This training gave me the knowledge I was looking for. I can now use it to for a business, product or portfolio review especially from the lender’s perspective."

AVAILABLE

AVAILABLE

AVAILABLE

Through e-learning, high-impact banker training is now practical and accessible.

Learn More Speak to a Community Bank SpecialistUnderstand. Apply. Differentiate.

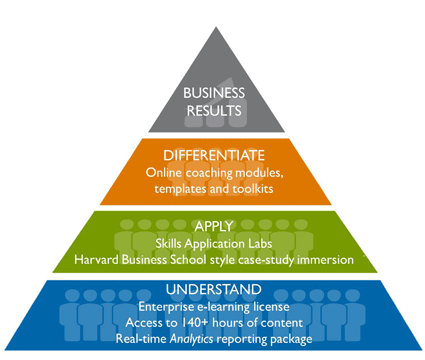

The financial industry is an extremely competitive marketplace where good talent is tough to attract and retain, and attention to the customer experience is front and center. These realities prompted us to develop the “Understand. Apply. Differentiate.” philosophy for developing solutions that are scalable, practical and effective.

Through Omega Performance training, your employees will better understand your customers, be able to apply that knowledge effectively, and consistently differentiate your bank in order to win more profitable business.

See CoursesEstablished in 1976, in California, Omega Performance started out as a multi-disciplinary training provider - delivering performance improvement training across several functions of the lending enterprise. As our portfolio of clients and training program success demonstrated consistent growth, Omega promptly expanded its geographic footprint to meet global demand, setting up highly active offices in key global markets.

Almost 40 years since our inception, Omega Performance continues to deliver high-impact credit training throughout the world, with head offices in the United States, Singapore, and Australia.

Speak to a Community Bank Specialist

Arlington, VA 22203, USA

Singapore, 238164

Sydney, NSW 2000, Australia

+1 703 558 4000

+65 3158 9545

+61 2 9080 4380